Interest grows in retail real estate transformation

Proportion of retail real estate sold for redevelopment has doubled

Despite the current uncertainty, investors and developers are showing a readiness to invest in retail real estate in order to renovate the part hit by structural vacancy and convert it into housing or for other use. Of all major and active retail real estate investors, 30% say they are interested in retail properties that are suitable for redevelopment. This interest has seen a sharp increase as a result of coronavirus. This is what real estate advisor CBRE concludes based on sales currently in the process of negotiation or already realised.

Experience from offices market

It is primarily investors with experience in transforming vacant offices who are now showing an interest in retail property. They see increasing opportunities in transformation into residential properties, healthcare real estate or other social functions, such as education. This is because the value of certain retail real estate that has fallen into disuse has declined sufficiently relative to housing or another use in order to justify the cost of investment.

Transformation increasingly common

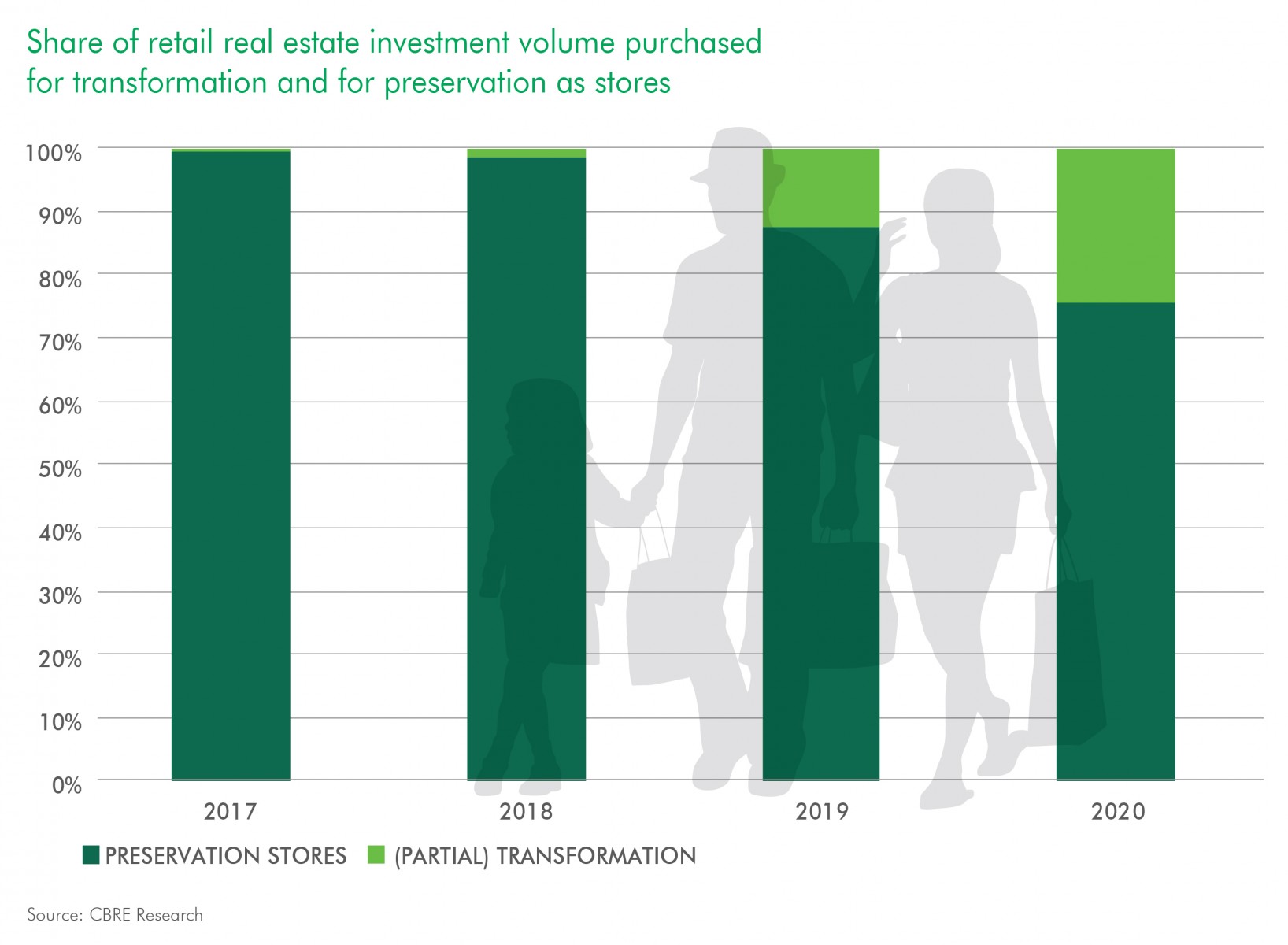

Investors and developers are now particularly interested in retail properties located in streets leading to central retail areas, retail space above ground-floor level, large local shopping centres and large retail buildings in city centres or retail space on the periphery of central retail areas. These players are acquiring this real estate with a view to redeveloping it. It is estimated that this accounted for around 24% of all of the capital invested in retail real estate during the first six months of 2020. This is twice as much as the figure of 12% for the whole of 2019.

V&D department stores show the way

“Increasingly, we are seeing former V&D department stores being sold as redevelopment plans. In such cases, the former owner readies the building for transformation and sells it as such to a new owner who has the knowledge and experience to complete the renovation. Examples of this include the former V&D buildings in Rijswijk, Nijmegen, Arnhem, Dordrecht and Rotterdam,” says Lodewijk Buijs, Senior Director of Retail Real Estate at CBRE.

Retail market differences: some stores will always be retail real estate

Lodewijk continues: “Far from all of the retail real estate is being converted for an alternative use. Retail properties in key parts of main shopping centres in city centres, shopping centres used for daily shopping and out-of-town furniture boulevards remain attractive to investors. Stores that become vacant in city centres continue to be let to up-and-coming online retailers eager to have a store, independent retailers who see opportunities or to retail chains wishing to open more branches. For example, Danish design and furniture brand Bolia recently acquired the lease for new retail space in Haarlem, which will become the brand’s fifth location in the Netherlands. This entire transaction was concluded after the outbreak of coronavirus.”

Appeal to local authorities: cooperate

“Retail real estate that has fallen into disuse often offers great opportunities for redevelopment and for bringing new life to the area. Despite this, transforming disused retail real estate can prove difficult, for example because efforts to change the zoning plan do not always run smoothly. In many cases, there is already consumer demand for a different type of real estate and investors and developers are standing by to take action. Local authorities do not always realise what opportunities are out there for continuing to develop city centres. They can play a key role in this process by facilitating solutions to smooth out the difference in terms of demand and supply. This is just the right time for making proactive changes to zoning plans and regulations,” concludes Lodewijk.