Another record for the healthcare real estate market: investment volume exceeds one-billion euro

Investor interest continues to grow, for reasons including a shortage in housing for senior citizens

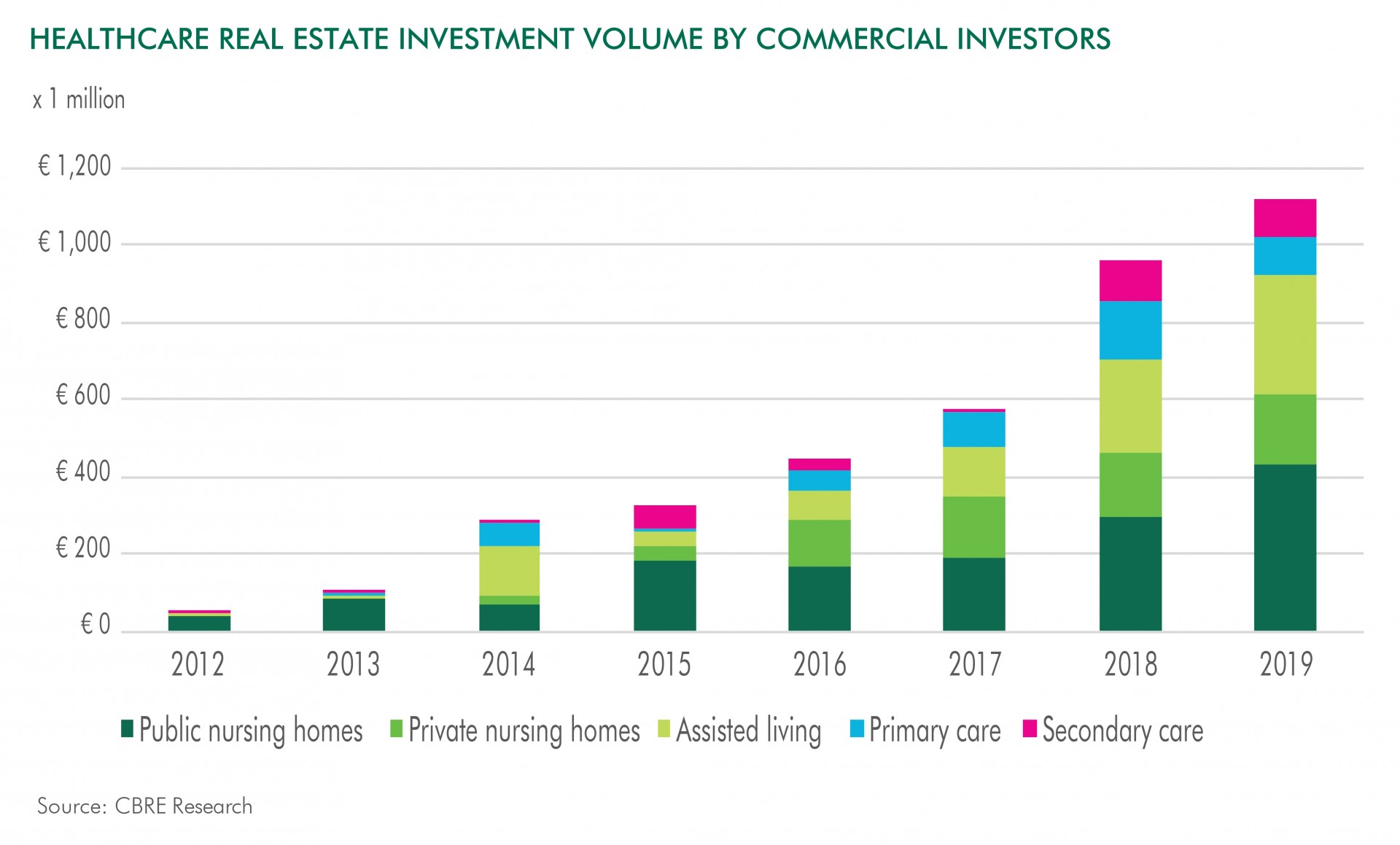

2019 was a record year for the healthcare real estate investment market. For the first time, the one-billion euro threshold was exceeded. The invested capital has increased in almost every sector and was 17% higher in 2019 compared to 2018. The total number of transactions also rose by 25%. These are the results published today in CBRE’s Real Estate Outlook 2020, the real estate advisor’s annual analysis of the Dutch real estate market, and the enclosed Healthcare real estate special.

Investment volume

The total investment volume amounts to € 1.125 billion. Most investments were made in intramural nursing homes and extramural care homes, as investors are acting on increasing demand for housing for senior citizens in need of care.

- Combined, the four major investors in 2019 had an investment volume of € 427, which equates to 37% of the total market.

- The highest volume was invested in Noord-Brabant (19%), followed by Utrecht (18%), Zuid-Holland (13%), and Noord-Holland (12%).

- Approximately 29% of the volume was sold by developers, and about 28% by healthcare providers. The sale of healthcare real estate between investors is slowly beginning to pick up: around 24% of the investment volume was sold by one investor to another.

- Some 39% of the number of transactions involved intramural real estate. Some 28% are extramural sheltered housing apartments, while 16% are (extramural) private residential care sites. Other transactions are primary healthcare centres (9%) and secondary care clinics (9%).

“The interest in healthcare real estate continues to increase, both among Dutch and foreign parties. Parties with no previous interest in the healthcare real estate market are now exploring their options. We also see that investors are even showing a tentative interest in sectors they previously avoided, such as disabled care and mental health care,”

Shortage of residential care facilities remains dire

Despite the growing investment volume, shortages in homes for senior citizens and nursing home facilities continue to grow. This is partly due to the ageing population and changes to regulations. “More and more senior citizens in need of care continue to live at home, although most homes are not suited to their needs. The demand for suitable housing and new residential care concepts is rising sharply, but supply continues to lag behind,” says Annette van der Poel.

Joint approach absolutely vital

Prerequisites for tackling these shortages and developing new care facilities are specialist knowledge and expertise.

“Municipalities, developers and investors should join forces more often to ensure that healthcare real estate is set up and managed at the highest level. The peak for the ageing population is expected in 2035 and great strides can be made before that time through efficient cooperation. Municipalities are also tasked with a careful review of their housing policy. Providing suitable options for senior citizens will also boost fluidity in the local housing market,” says Annette van der Poel.

More information and figures for the Dutch healthcare real estate market can be found in the Real Estate Outlook 2020.

For more in-depth information on the healthcare real estate market, please download our Healthcare real estate special.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (based on 2019 revenue). The company has more than 100,000 employees (excluding affiliates) and serves real estate investors and occupiers through more than 530 offices (excluding affiliates) worldwide. CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.