Dark stores and e-tailers in pursuit of consumers

Flash delivery companies focus on speed, e-tailers on service

Flash delivery companies with their dark stores, and e-tailers with physical stores, have set their sights on securing their physical proximity to consumers. CBRE Netherlands – part of the listed CBRE Group, the world's largest real estate consultancy – has come to this conclusion after investigating the development of logistics hubs in the Netherlands.

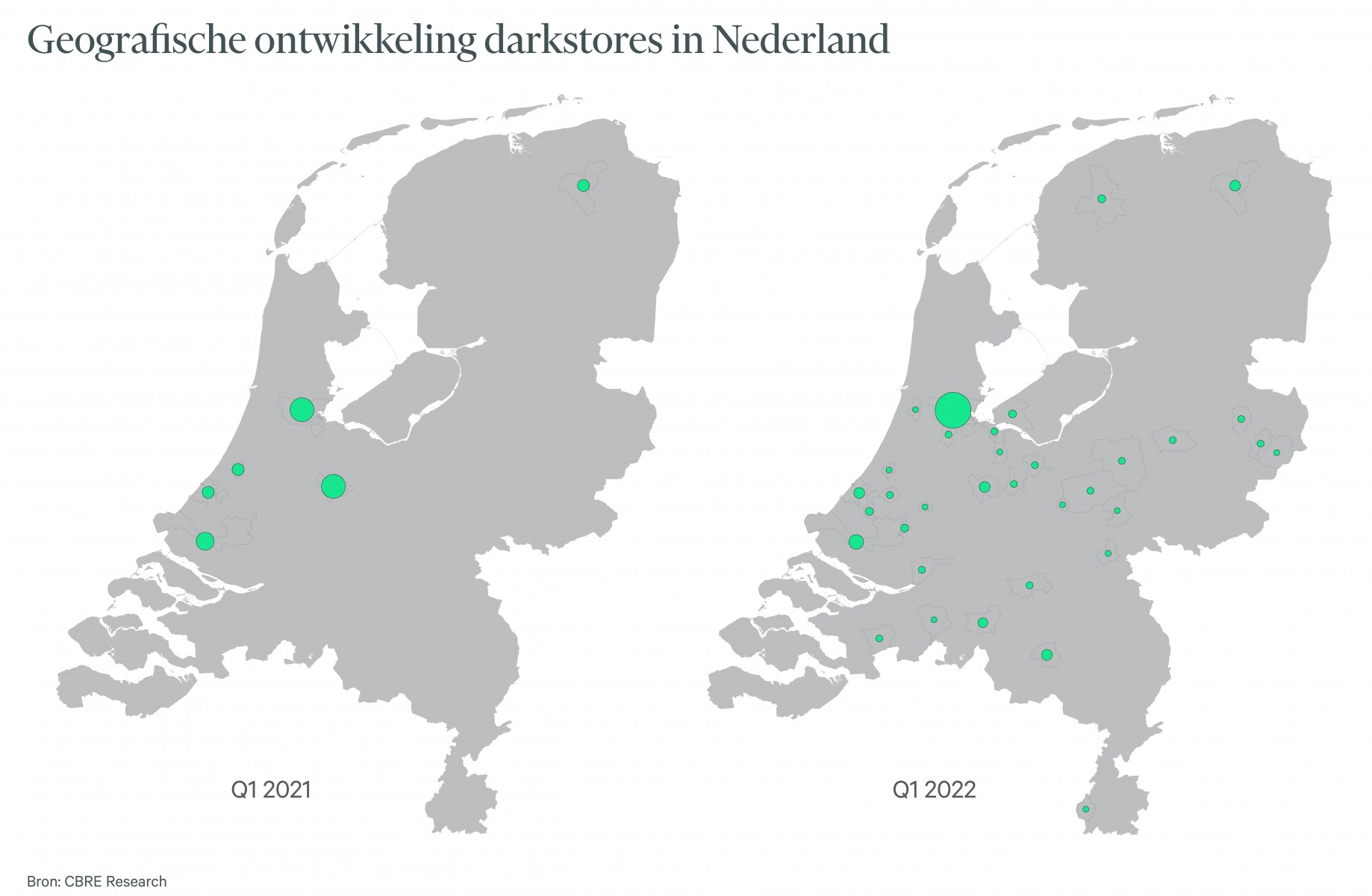

In just one year, the number of dark stores has increased tenfold. Dark stores, which are effectively miniature warehouses run by flash delivery companies, have spread at lightning speed, starting from a few hubs in Amsterdam to nearly a hundred locations in 35 cities.

Despite this explosive growth and the ever-increasing demand for online grocery delivery services, the same survey shows that e-tailers are exploiting opportunities for expansion by moving into ‘offline’ stores. More than 40 online stores such as Ace & Tate, Coolblue and Fietsenwinkel.nl have already opened physical stores in the Netherlands. Over the past ten years, companies that were originally online-based have opened 140 physical shops.

These trends indicate that online shopping has entered a new phase in its development. On the one hand, flash delivery is a response to the demand for ever faster delivery, while on the other hand, e-tailers are exploiting the opportunity to expand their service and offer a total brand experience by means of physical shops.

In addition to changes on the supply side, consumer demands are also evolving. Lockdowns over the past two years have led to exponential growth in online orders (and returns). In total, we did almost 20% of our retail spending online, making the Netherlands one of the world leaders in this trend. While this share will decline slightly in the near future, it is set to surpass the historic high of 2021 by 2025. More than 30.4% of total retail spending will be done online by 2030.

In addition, consumers are becoming more demanding when it comes to parcel services. From flexible delivery times to same-day delivery and from cheap to sustainable parcel delivery, the ever greater expectations are leading to changes in the logistics network. The demand for logistics locations in close proximity to sufficient consumers will increase.

“When almost one-third of Dutch retail spending takes place online, this is bound to have implications for urban mobility flows. To ensure that our surroundings remain liveable, we need to consider structure and guidelines, including space for the logistics network in and around the city,’ says Jim Orsel, head of Industrial & Logistics at CBRE. ‘Specifically, this means three things. Firstly, logistics space must be included in large-scale housing developments on industrial estates. The zoning of large-scale/peripheral retail locations must be handled generously in order to accommodate e-commerce and the supply chain of the future. Finally, city centre municipalities need to respond to altered and future consumer spending patterns, identifying locations that can serve as last-mile hubs or dark stores, and the conditions under which this is possible.”