First quarter of 2021 sees more investments in logistics real estate than in residential

Slow start in residential sector due to transfer tax

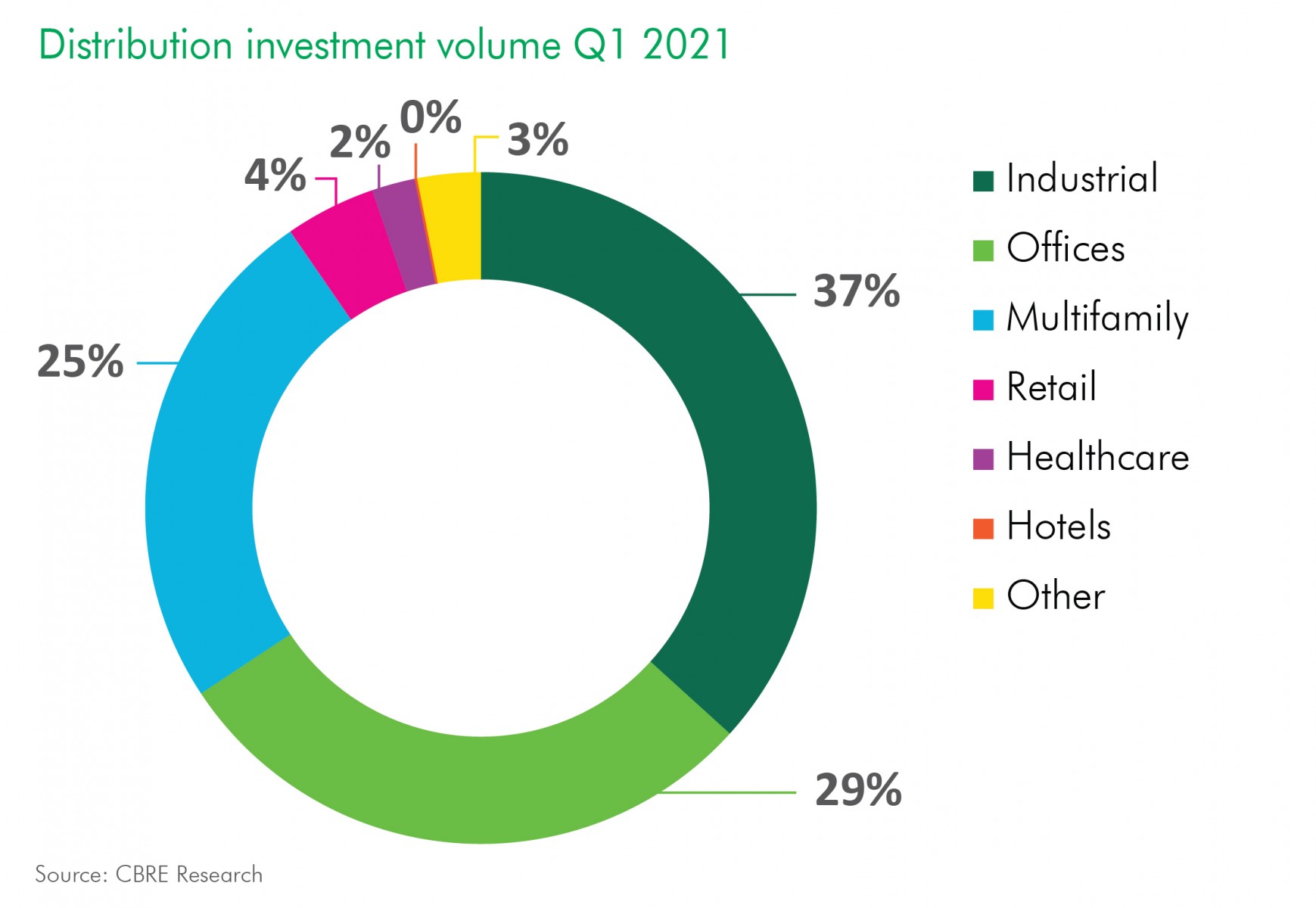

For the first time since 2014, the investment volume in the logistics real estate sector exceeded that of residential last quarter. Logistics real estate is benefiting from the increased demand for distribution centres for e-commerce. Over the past three months, even offices were more popular among investors than residential properties. The total volume for the first quarter of 2021 amounts to €2.1 billion, of which 37% was invested in logistics real estate, 29% in offices and 25% in residential. The quarterly volume dropped significantly compared to the same period last year: overall, investments decreased by 44%.

Fewer residential investments

“The drop in residential investment is mainly due to the increased transfer tax, which came into effect in January. As a result of this, many portfolio sales that were originally planned for 2021 were already sold in late 2020. We do see that the sale of new developments is continuing at a steady clip,” says Thomas Westerhof, Head of Residential Investments at CBRE.

Sale of largest distribution centre in the Netherlands

Investments in logistics real estate peaked with the recent sale of the Zalando distribution centre in Bleiswijk. This is the largest e-fulfilment centre in the Netherlands, spanning more than 140,000 sq. m. Its selling price made it the largest single asset deal ever in logistics real estate, accounting for over a quarter of the total logistics investment volume.

Large transactions in offices

The normal investment ratios between the various real estate sectors were shaken up considerably during the past quarter, and this was not just due to the transfer tax and the peak in logistics. In the office sector – which has so far mostly seen relatively low investment volumes – a number of large portfolio transactions took place, accounting for almost a third of the total investment volume for offices.

Catch-up effect in the second half of 2021

“Exactly how real estate investors will spend their money next quarter remains to be seen. Logistics continues to perform well, but the residential and office sectors will see little action for the time being. We have noticed, however, that many sales processes are being postponed until it’s possible to travel again. That’s why we expect much of the current backlog to be cleared in the second half of this year,” says Bart Verhelst, Executive Director Capital Markets at CBRE.