Growth of food sector limits contraction of logistics real estate sector

In the first half of 2020, approximately one million sq. m. of logistics real estate was leased or pre-let; a decline of 17% compared to the same period in 2019. Results of market analyses by real estate advisor CBRE show that this contraction is limited, mainly as a result of the strong growth of the food sector. A temporary decline of activity in the logistics market was to be expected. Considering the strong foundations of the market and the growing demand for logistics space, CBRE expects a speedy recovery.

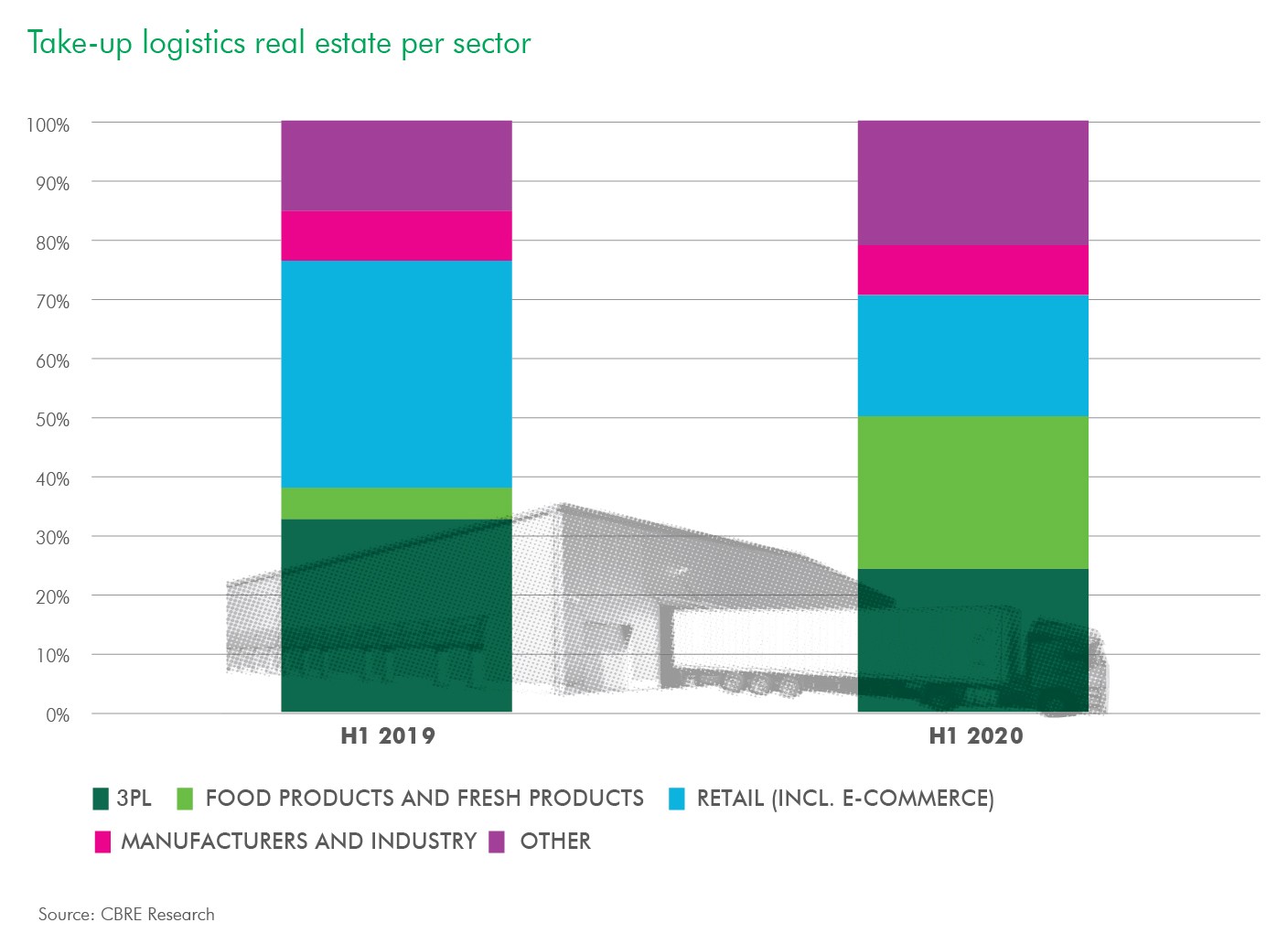

Food sector share has grown from 5% to 25%

The take-up in almost all sectors dropped with one notable exception: logistics companies in the food sector, who actually rented more office space in recent months. During the first half of 2020 this sector was responsible for 25% of the take-up volume, which was approximately five times as much as in the same period in 2019. Companies in other sectors decided to defer decisions about logistics real estate and future expansions mainly due to uncertainty about future order volumes and cargo volumes. The take-up from third-party logistics service providers (3PL) dropped by roughly 40% in the first half of 2020.

E-commerce driving force behind demand

Director of Industrial & Logistics at CBRE, Jim Orsel, views the future of logistics real estate in a positive light. “Online retailers – in the food sector in particular but also in other sectors – experienced peak order volumes in the weeks after the implementation of the first coronavirus measures, resulting in a temporary demand for extra space by these parties,” he explained. “E-commerce is also a structural driving force behind the increasing demand for logistics real estate. The e-commerce share of the total retail sales in the Netherlands is on the rise and the coronavirus crisis is expected to further boost this trend. We also expect to see companies create greater stockpiles. Both factors will result in an increase in the demand in the longer term.”

Greater balance in supply chain

Jim Orsel added that “the coronavirus crisis has highlighted the societal importance of the logistics sector. Consumers, authorities and companies have all experienced a temporary disruption in the chain. We therefore expect businesses to focus more on creating a resilient supply chain that is less sensitive to future disruptions and on striking the right balance between just-in-time and safety stocks.”