Office market in The Hague remains healthy

-

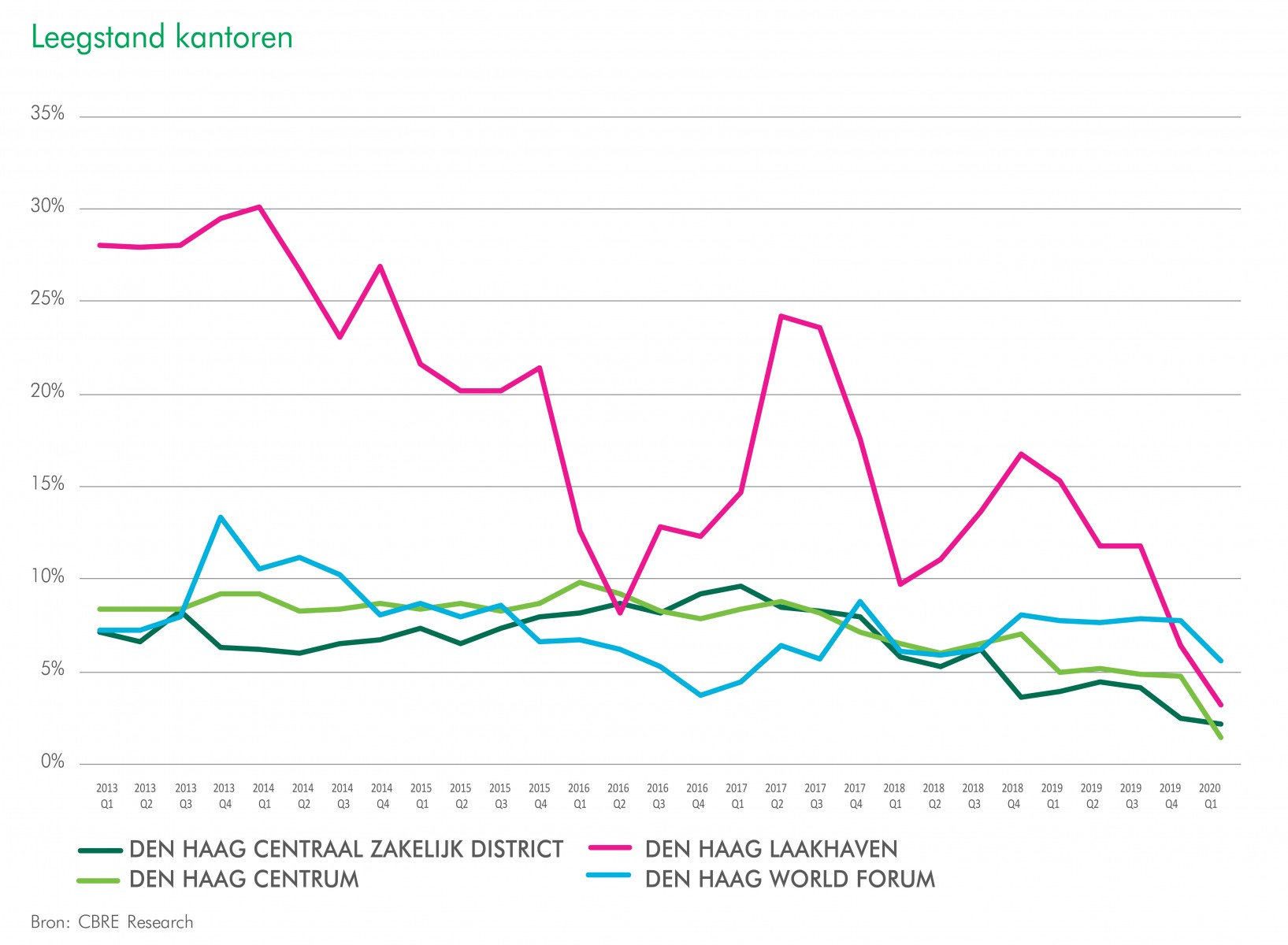

The office market in The Hague is more robust today than it was during the credit crisis of 2008, according to real estate consultant CBRE. Vacancy in the first quarter of this year was low, at 4.4%, and organisations are looking for approximately 100,000 sq. m. of office space in the city.

The credit crisis of 2008 hit hard, and the office market in The Hague was not spared. This was partly because the Central Government Real Estate Agency placed a lot of its real estate on the market at around the same time. This had a major impact – there was an increase in vacancy, at a time when virtually no new office space was being leased or sold. But the city is in better shape today. Many office buildings have been taken off the market and converted into homes. As a result, the city’s office stock has decreased by about 15%. And there has hardly been any new-build since the credit crisis, which means that the market is now healthier and vacancy is very low. In fact, vacancy is now at an all-time low of around 2% in the area around Beatrixlaan, Wijnhaven and the historic centre of the city.

Amount of vacant office space as a percentage of total stock

Added resilience

Roel Lamb, Director of CBRE The Hague: ‘The office market is in good shape. The Hague has a number of advantages that mean the market is more resilient today. The main focus is on public and stable business service providers, of which The Hague is home to many. Together, organisations in these two sectors occupy 65% of office space in The Hague. However, flex workers who are being affected by the current uncertainty and have less work will also need less office space. The oil and gas sector is currently feeling the effects of the low oil price, too. We are seeing a decline in the demand for office space from that sector.’

Expected effects

Despite its strong starting position, the uncertainty in the market is causing a number of companies in The Hague to reconsider their provision of office space. ‘The Hague is unlikely to escape the current crisis entirely. We are already seeing that ongoing lease negotiations are taking longer than expected, and that tenants are presenting additional flexibility requirements. In the short term, companies are concerned about when employees may return to their offices. But even once the crisis passes, they will probably want more flexibility in order to be able to accommodate possible changes in working practices. We don’t anticipate a reduction in the amount of office space, but demand this year will likely be lower than last year. This could also put a brake on the growth in rents that we have seen in recent years,’ says Lamb.

Continuing demand

However, the market has by no means stalled. One positive trend is that there is still demand for 100,000 sq. m. of office space in the city, with the majority of this demand coming from government. It is looking for tens of thousands of meters of office space, preferably to purchase. ‘However, it is not yet clear whether this demand will be affected,’ says Roel Lamb. ‘We think the public sector will also be looking again at its requirements for office space. The question is whether this will lead to higher or lower demand. It is still too early to answer that question. The public sector is and will remain a stable and important factor in the health of the economy in The Hague, including the office market.’

‘All in all, we expect the office market to weather the current crisis, given the situation. We don’t predict a major fall in demand or an increase in vacancy for the time being,’ concludes Roel Lamb.