Record real estate investments in first half year

More and more private investment in commercial real estate

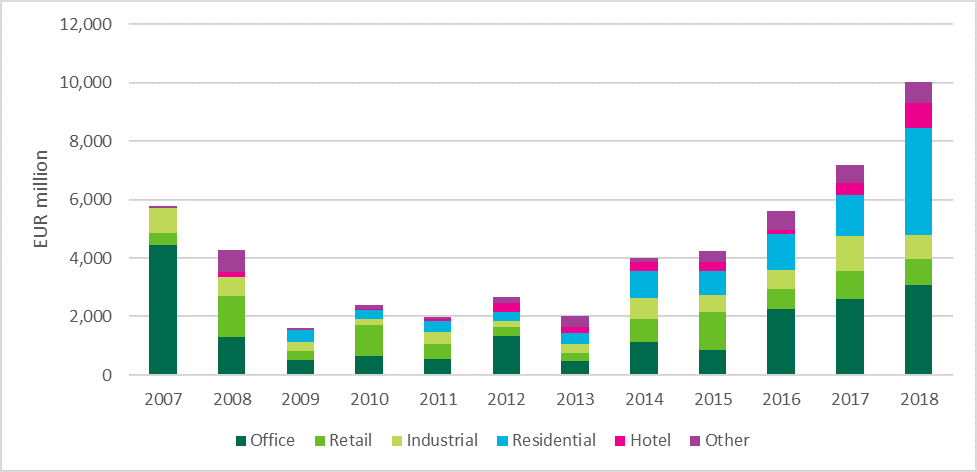

Investors acquired Dutch real estate worth €10 billion in the first half of 2018. The investment volume has never before reached these levels in the first half year. There has also been a strong increase in real estate investments by private investors. These are the results of market analyses by international real estate advisor CBRE.

Strong first half year for residential investments

Of the total investment volume in the first half of 2018, the greatest share went into residential properties, whereas the office market has traditionally been the largest sector. A record amount of €3.6 billion was invested in residential properties, partly driven by Vesteda’s acquisition of a residential portfolio from Nationale Nederlanden for €1.5 billion. The growth in investment in the hotel sector is also striking: €826m, more than double the figure for the first half of 2017. This represents the highest investment volume in this sector to date.

Investment volumes in the Netherlands by sector, first half of 2018

More private investments

The increase in the number of small to medium-sized transactions (up to €15m) is noteworthy. Private investors are particularly active in this segment, where the investment volume was €1.4 billion in the first half of 2018, which is 35% higher compared to the same period last year.

Private investors, mostly with a background in the SME sector, often acquire properties such as offices or shops to redevelop them through renovation and/or rezoning. Following a number of profitable years, these entrepreneurs are now moving more and more into the professional investment market.

In today’s market, institutional investors know the time is right to realign their real estate portfolios. They are focusing more on properties in their core region that fit their current real estate strategy. Private investors are responding to this trend as they make their comeback in the real estate market. Moreover, the possibilities for securing financing have improved. As a result, we are seeing more and more investment in real estate nationwide, which is a clear break with the general trend over the past several years.

Private investments in the region

Of transactions up to €15m, most investments took place outside the four major cities: 66% of these investments were made elsewhere in the Netherlands. Of the four major cities, Amsterdam saw the greatest investment volume, followed by Rotterdam, Utrecht and The Hague. Outside the four major cities, the greatest investment volume was in Eindhoven, followed by Arnhem, Groningen, Maastricht and Helmond.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (based on 2019 revenue). The company has more than 100,000 employees (excluding affiliates) and serves real estate investors and occupiers through more than 530 offices (excluding affiliates) worldwide. CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.