“Residential real estate now the largest investment sector in Europe”

Netherlands in the top 5 of international investments

A CBRE analysis shows that the investment volume in the European housing market has grown by 699% in the last ten years (a growth of € 49.8 billion). In 2018, a record amount of € 57 billion was invested in European homes. CBRE expects that the residential sector will become the largest sector in Europe, where traditionally the office market was the largest sector1.

Same trend in the Netherlands

The housing market is also becoming the dominant sector in the Netherlands. In 2018 and in the first half of 2019, housing was already our country’s largest investment category. Over 33% of the available total Dutch investment volume in 2018 consisted of homes (€6.9 billion). In the first half of 2019, this was already up to € 4.1 billion, which equals 49% of the total.

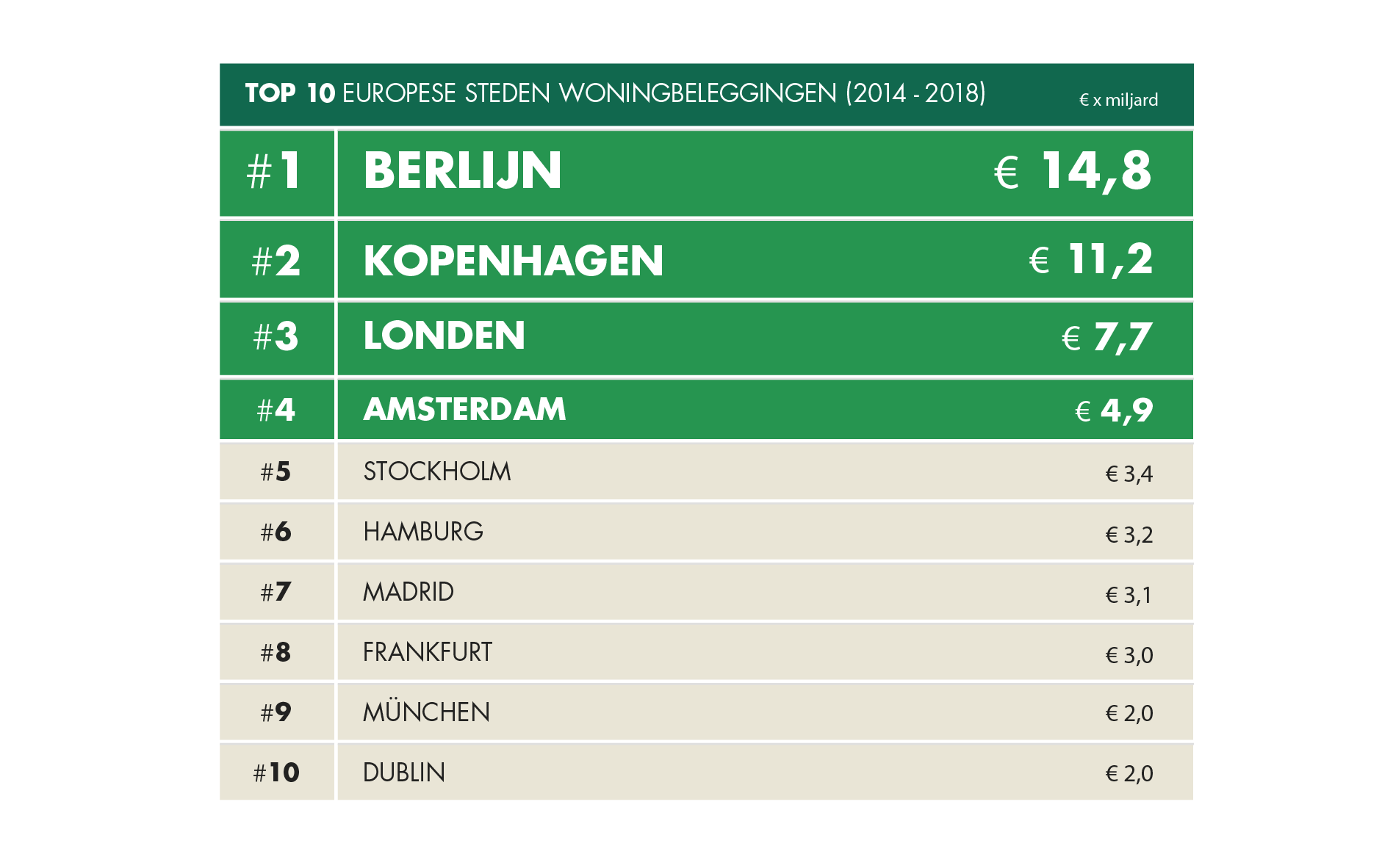

Amsterdam in the European top 5

Amsterdam is in fourth place in the ranking for most popular European locations for residential investments in the past four years. The Dutch residential market in general, and the Amsterdam market in particular, draws institutional investments from all over the world. These long-term investors include pension funds and insurance firms. CBRE expects that the demand for investments in rental homes will remain high in the coming years.

“In the United States, the residential sector has been the largest investment sector for years. Evidence suggests that the European market is following this development. Institutional investors are increasingly investing in residential real estate because long-term investments in homes provide a reasonable return at limited risk, particularly in this time of low interest rates. The sector is also viewed as more professional on an international level and more appealing as a result of trends such as urbanisation, smaller households and a growing preference for rent.”

Residential real estate now the largest investment sector in the Netherlands

Share of investment volume per sector in %

Sources of capital flows increasingly international

In its analysis, CBRE reviewed the sources of capital and found that capital flows have become much more global. Although European investors are still responsible for the largest volume in Europe, the percentage has fallen from 67% in 2011 to 50% in 2018. North-American investors are the most active investors from outside Europe. This group consists of a mix of private equity investors from the US and REIT investors from Canada. In terms of the type of investors, REITs and other listed funds invested the most capital in 2018.

The complete analysis can be found here.

1. The office market in Europe is currently the largest investment sector, followed by the housing market.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (based on 2019 revenue). The company has more than 100,000 employees (excluding affiliates) and serves real estate investors and occupiers through more than 530 offices (excluding affiliates) worldwide. CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.