“Write-downs and vacancies around the corner for hotel sector”

Hotel real estate market set to become a specialist sector again

The hotel market is affected a lot the coronavirus crisis. Occupancy rates fell below 10% in April and May, and several hotels have already gone bankrupt. While things might seem to be heading in the right direction now that tourism is starting to pick up again, the outlook for the sector is still far from positive, as business travellers will not be returning anytime soon. Hotel property owners must act quickly to prevent bankruptcies, write-downs and vacancies. As a result of this crisis, the hotel real estate sector will soon return to being a specialist sector again, says real estate advisor CBRE. Market recovery is expected from 2021 onwards.

Hotel property owners yet to face up to new reality

“Over the past several months, many hotel operators have been granted rent deferrals and reductions by their landlords. Now that the economy is starting to bounce back, the sector seems to expect that rental income will be returning to normal, pre-pandemic levels soon. But in many cases, this scenario is far from likely,” says Jan Steinebach, Director Hotels at CBRE. “Bankruptcies are looming and business travel, which many hotels depend on, will remain extremely limited for the foreseeable future. Hotel property owners have yet to face up to this new reality, putting their investments at risk. Quick and appropriate action is required to prevent the situation from getting worse.”

Business travel suspended

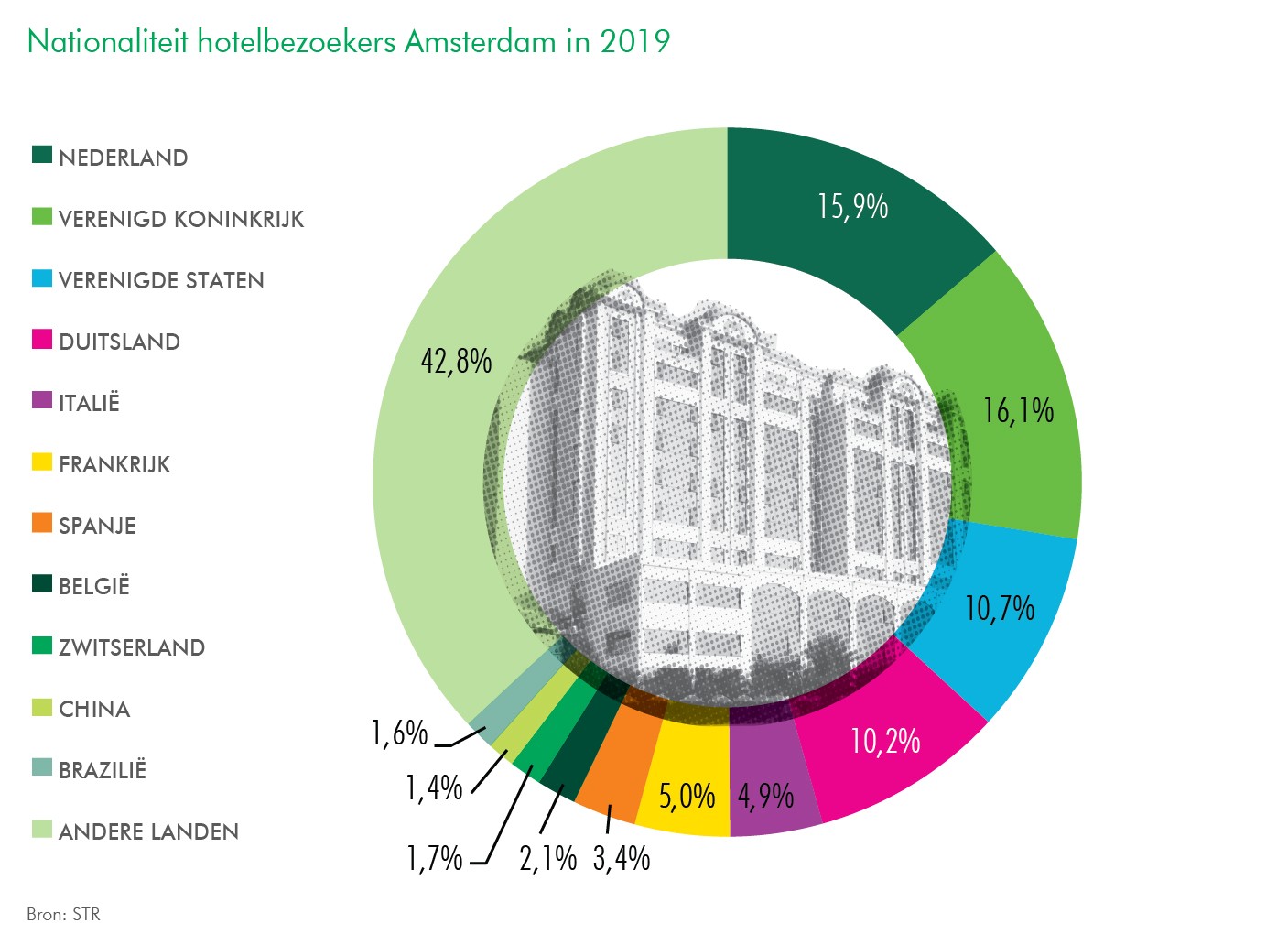

Normally, roughly half of all hotel bookings in Amsterdam are business visits. This share is even more substantial in other cities in the Netherlands. While the summer months usually see a slump in business travel, September, October and November are always peak months for conferences. But as a result of the pandemic, many major events have already been cancelled: there will be no SAIL Amsterdam this year, and large trade fairs and conferences at the RAI convention centre, such as the International Broadcasting Conference, have been called off. “That means a significant loss of income for the hotel industry – and this is just Amsterdam we’re talking about. Business events have been cancelled everywhere, and those that haven’t are being slimmed down in order to comply with social-distancing measures,” says Steinebach.

Vacancies and write-downs

If the sector fails to act quickly, a partial or complete loss of rental income as a result of the pandemic could lead to lower property values and vacancies, and hotel owners could even get stuck with unsaleable real estate. Hotels in business districts and suburban neighbourhoods are particularly at risk.

“To avoid this from happening, hotel owners and hotel operators should get together as quickly as possible to draw up a plan and take concrete steps to deal with this crisis. These steps could entail measures such as temporary contract changes and payment restructuring. Another option owners have is reassessing their real estate strategy,” says Steinebach.

But no matter how the sector responds, he suspects that vacancies will be unavoidable. “This also offers opportunities. Hotel properties could be redeveloped into healthcare facilities, for example – which are currently in very short supply – or perhaps into homes or offices.”

A specialist sector once again

“The hotel real estate market is set to become a specialist sector again,” Steinebach predicts. “In recent years, many parties have entered the sector looking for security, stability and long-term investments. These new players, who assumed that any sector-specific expertise was not needed, will now withdraw from the market. The same thing happened in the wake of the 2008 financial crisis. Market knowledge will become more important again to make sound investments.”

“In addition, the relationship between hotel owners and hotel operators will change drastically. They need each other now more than ever, and they will have to make it through this crisis together. The only way to do that is by making solid mutual agreements, which also requires a great deal of trust and knowledge. They will have to support each other in this,” says Steinebach.

“We will definitely see this reflected in the sector’s contract forms – rental income will become much more dependent on performance. We could see things like flexible rent contracts or management contracts, depending on the type of investor.”

Recovery from 2021 onwards

Recovery in the hotel real estate market is not expected until 2021. “The situation continues to be highly uncertain, and many hotels are in ‘operational distress’, meaning they are unable to meet their financial obligations to the property owner or lender due to a lack of cash flow. We expect to see a peak in bankruptcies in the fourth quarter of this year, after which the market will slowly gain traction and pick up steam again, which will continue into 2022,” says Steinebach.