Smaller growth expected in Brabant office cities and changes to the function of offices

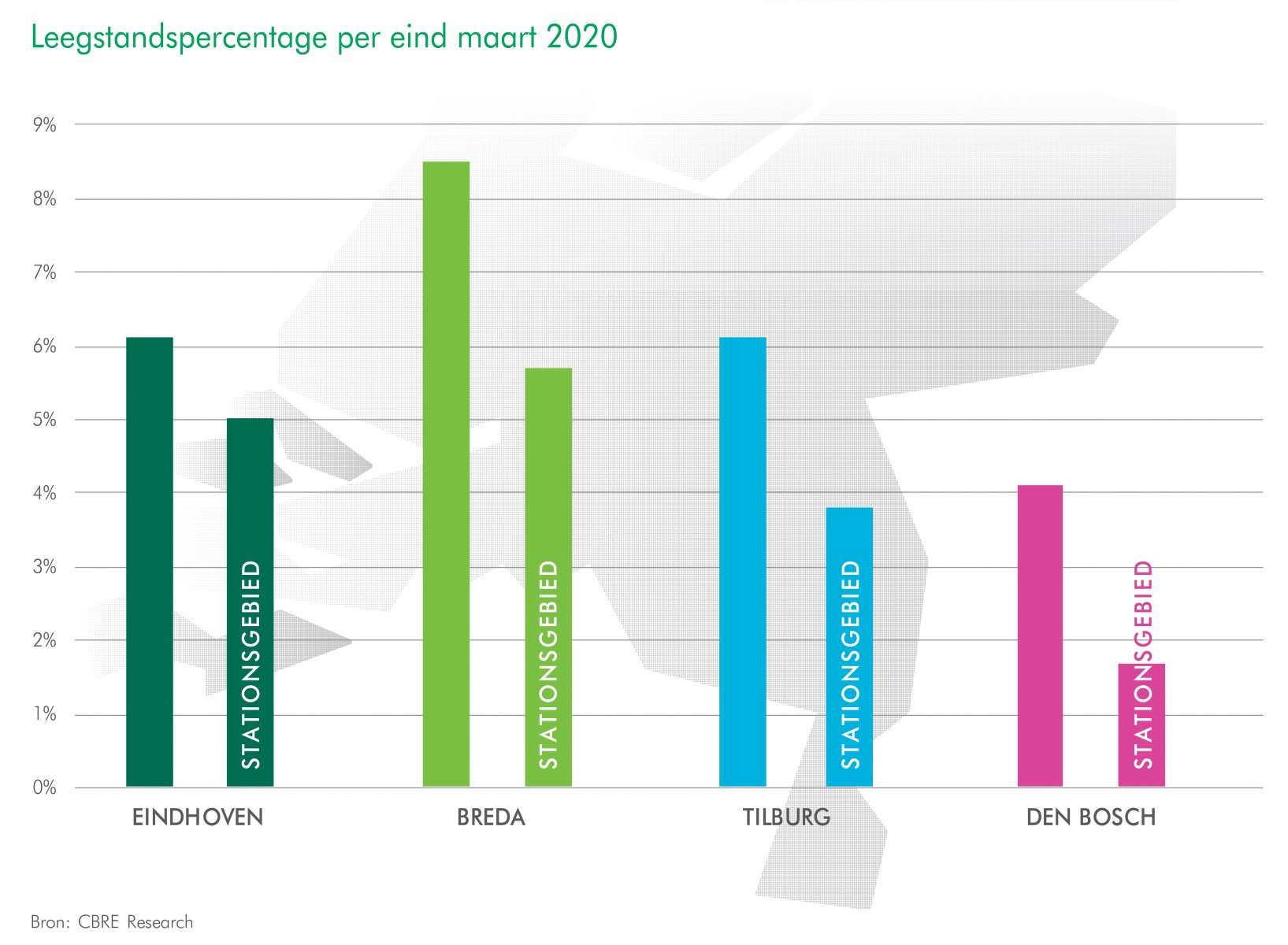

The expectation is that the growth in the office market will slow down. The office markets in the major cities in the province of Brabant are more robust today than during the financial crisis of 2008, according to real estate advisor CBRE. The cities have a very limited vacancy rate: 6% in Eindhoven, 8% in Breda, 4% in ‘s-Hertogenbosch and 6% in Tilburg. This means that the availability of office space in the coming period will continue to remain limited. Vacancy rates are especially low in city centres and around the major railway stations: from 1.7% in ‘s-Hertogenbosch to 5.7% in Breda, and the stations in Eindhoven and Tilburg in between. At the same time a large number of searches preceding the coronavirus crisis have not been cancelled. As a result, the current demand for office space in Eindhoven is approximately 83,000 sq. m. However it is vital that changes to the function of office buildings and the demands in the post-corona era are taken into consideration.

The financial crisis of 2008 and the years that followed were challenging times for the office markets of the major cities in Brabant. Companies and organisations were forced to adapt their internal organisation to challenging circumstances in the market, resulting in a decline in the need for workspaces. The demand for office space was more and more concentrated in the areas around the major railway stations and other easily accessible areas with a large number of facilities. By contrast, the vacancy rate in other areas rose sharply, because new office buildings had been built there in the period leading up to the financial crisis. The situation is different now. In recent years no large-scale office buildings have been built and various existing office buildings were converted to mainly homes or hotels. There is also a limited number of plans for new builds in the office market. At present the only construction project built for the open market (i.e. not leased or sold yet) is 27,000 sq. m. of office space at Eindhoven De Bunker. Plans for the construction of two additional office buildings of approximately 30,000 sq. m. in total are currently well underway. Two new office buildings of approximately 9,500 sq. m. and 10,000 sq. m. are also being built for the open market in ‘s-Hertogenbosch and Tilburg.

Amount of vacant office space as a percentage of total stock

New function of the office

“Owners in the province of Brabant have made considerable investments in recent years in the renovation and modernisation of existing office space, giving businesses room for growth. After weeks of working from home in droves, it has become clear that the function of office spaces will be changing considerably. Remote working has been a growing trend for some time and a breakthrough was forecast for 2030, however this trend has now accelerated. Companies and employees have discovered that working from home is a solid alternative, resulting in inevitable changes to the ways in which we use traditional office buildings. A significant shift will occur in the ratio between workspaces and meeting spaces. For these get-togethers flexible meeting rooms and attractive corporate cafés and restaurants could prove appealing alternatives. The technology in office buildings will continue to play a larger role too; a trend that was already gaining momentum. Previously, however, the main focus was on efficiency and a shift to health and safety can now be observed,” explained Eric Harmsen, Director of CBRE Eindhoven.

Growth is stagnating but new builds are welcome

“In general, growth is excepted to stabilise. We observe that the demand in Eindhoven has dropped from approximately 120,000 sq. m. to roughly 83,000 sq. m. This reduction is mainly due to the fact that companies that have no pressing need to find new housing have postponed any searches for alternative housing for the foreseeable future. However, in order to meet the current demand in the knowledge that development will take three to four years, we call on governing bodies to take this opportunity to talk to the market about plans for new builds. At the same time we are in talks with businesses about the changing function of those spaces,” Mr. Harmsen concluded.