Volume of investment into healthcare real estate down with 33%, but demand for new locations remains robust

Interest from foreign parties is increasing

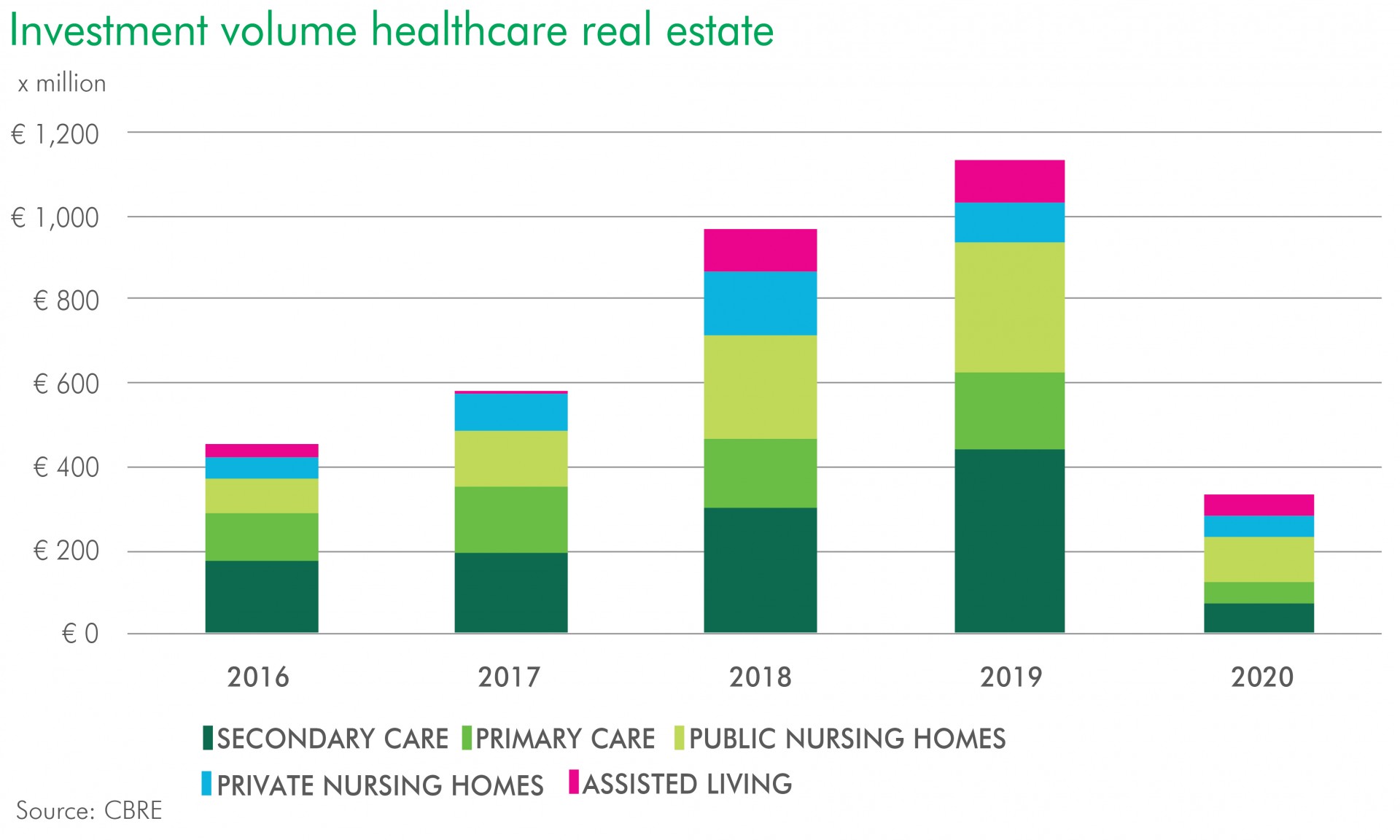

The investment volume for the past six months was € 327 million, around 33% lower than in the same period last year (€ 489 million). An increase in market activity is expected from September onwards. Despite the coronavirus pandemic, there continues to be demand for healthcare real estate due to the shortage of suitable care locations and the ageing population. These strong market fundamentals are also generating increasing interest from abroad. These are the findings of the six-monthly Healthcare Real Estate Report from real estate advisor CBRE.

Investment volume

In the first half of 2020, investors acquired healthcare real estate worth approximately € 327 million. This represents a decrease of approximately 33% compared to the first half of 2019 (€ 489 million). This drop is mainly due to the coronavirus outbreak. Transactions have been delayed or objects have not (yet) been put on the market.

- The average volume per transaction was slightly lower than in H1 2019;

- The highest volume was invested in public nursing homes (38%), followed by assisted living facilities (24%), private nursing homes (19%) and primary care (17%);

- Transactions between public housing corporations of public parties are excluded.

Increased activity from September onwards

Despite the current lull in the investment market, generally due to the postponement of decisions, the demand for healthcare real estate remains significant. ‘Many healthcare operators have not had time to focus on their regular operations, and real estate decisions have been postponed as a result,’ explains Annette van der Poel, Associate Director for Healthcare. ‘This is one of the causes of the dip that we’re now seeing. However, there’s still a major shortage of healthcare real estate, in particular suitable housing for elderly people. And our population continues to age. As a result, and provided no new measures are needed to combat the virus, we expect this dip to be temporary and that we’ll see a return to significant investment activity from September onwards,’ says van der Poel. At the end of last year, figures from Statistics Netherlands showed that due to ‘double ageing’, by 2050 there could be as many as 4.8 million people aged over 65, with the number of people over 80 growing the most.

Interest from abroad

The healthcare real estate market is maturing and continues to professionalise, and this is drawing increasing interest from foreign parties, both from investors and operators. For example, the French companies Korian and Orpea have already taken over residential care concepts in the Netherlands and both parties would like to expand their number of beds here. ‘These parties have seen that the demand for new locations in this country is high, and that means there are opportunities here. We expect more new foreign parties to enter the Dutch market in the next few years, whether through acquisitions or the introduction of new residential care concepts,’ explains Annette van der Poel.

The importance of quality real estate for the care sector

The recent coronavirus pandemic has demonstrated the importance of good quality real estate for the care sector. ‘A temporary ban on visitors has had to be put in place in many locations,’ continues van der Poel. ‘In order to ensure that high-quality and flexible healthcare can be provided during times of crisis, the real estate available to healthcare providers needs to be of a good standard. For example, it is smart to design buildings in such a way that residents can be fully separated from each other when necessary, and that there are “neutral” (outdoor) spaces where visitors can be allowed. Sustainability and evidence-based design are two factors that can play a major role in this, contributing to the health, safety and mental well-being of residents.’

Read our six-monthly Healthcare Real Estate Report for more information about the investment market for healthcare real estate and evidence-based design in the healthcare sector.